st louis county personal property tax calculator

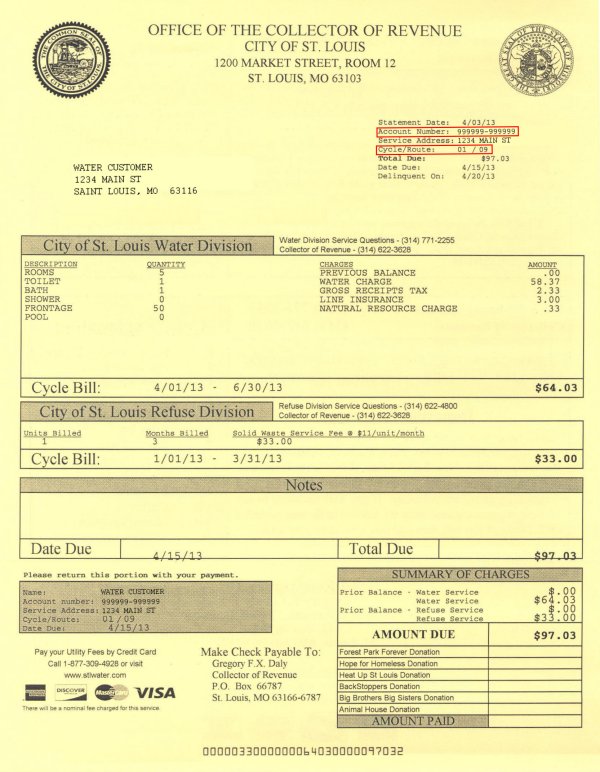

Account Number or Address. Motor Vehicle Trailer ATV and Watercraft Tax Calculator.

Real Estate Tax General Information

October 17th - 2nd Half Real Estate and Personal Property Taxes.

. Here it is effectively in the 25 - 3 depending on where you live. The 8 - 10 that is. Louis County collects on average 125 of a propertys.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The median property tax in St. Virginia does personal property tax relief for vehicles under 20k which taxes it a little over 1.

The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. Pay your Property Taxes. Free Comprehensive Details on Homes Property Near You.

To determine how much you owe perform the following two-part. Programs to help with Taxes. Expert Results for Free.

Such As Deeds Liens Property Tax More. Personal property is assessed at 33 and one-third percent one third of its value. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

Ad Get In-Depth Property Tax Data In Minutes. November 15th - 2nd Half Manufactured Home Taxes are due. To declare your personal property declare online by April 1st or download the printable forms.

Personal Property Tax Calculation Formula. Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. 41 South Central Avenue Clayton MO 63105.

Ad Just Enter your Zip for Property Values By Address in Your Area. May 16th - 1st Half Agricultural Property Taxes are due. The current statewide assessment rate for personal property is 33 13.

The following calculators can assist you with. Start Your Homeowner Search Today. Account Number number 700280.

Account Number or Address. November 15th - 2nd Half Agricultural Property Taxes are due. Taxes are imposed on the assessed value.

The value of your personal property is assessed. 15000 market value 3 5000 assessed value. Search Valuable Data On A Property.

Please contact the State Auditors Tax Rate Section if you have any questions regarding the calculation of property taxes at 573-751-4213. To declare your personal property declare online by April 1st or download the printable forms. Monday - Friday 8 AM - 5 PM.

Change Taxpayer Mailing Address. Louis County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. Account Number number 700280.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local. The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard.

County Assessor St Louis County Website

Online Payments And Forms St Louis County Website

Property Tax Webster Groves Mo Official Website

Property Tax How To Calculate Local Considerations

Online Payments And Forms St Louis County Website

2022 Best Places To Live In St Louis County Mo Niche

News Flash St Charles County Mo Civicengage

Missouri Property Tax Calculator Smartasset

Collector Of Revenue Faqs St Louis County Website

Property Taxes By State Bankrate

Solved You Are Considering The Purchase Of The House Located Chegg Com

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022

You Can Pay St Louis County Real Estate And Personal Property Taxes Online Fox 2